Bitcoin can't scale

A lot of bitcoiners believe that 2.1 quadrillion satoshis (the smallest divisible units of bitcoin) is more than enough for bitcoin to become a globally used currency. But that belief is rooted in misunderstanding. The problem was never how many sats exist, but how many can be used, stored, and tracked by the network.

Bitcoin was never going to be a realistic candidate for a global transactional currency. And it’s not because it lacks value or soundness. It's because of the very structure that makes it secure: the UTXO model.

Although the UTXO model is one of beauty and mathematical clarity, it is also one that fundamentally cannot scale beyond being a store of wealth. Many serious Bitcoin developers and thinkers understand this. But a large portion of the community was sold on the idea that Bitcoin would replace fiat and become the daily driver of global commerce.

The flaw lies in the actual math.

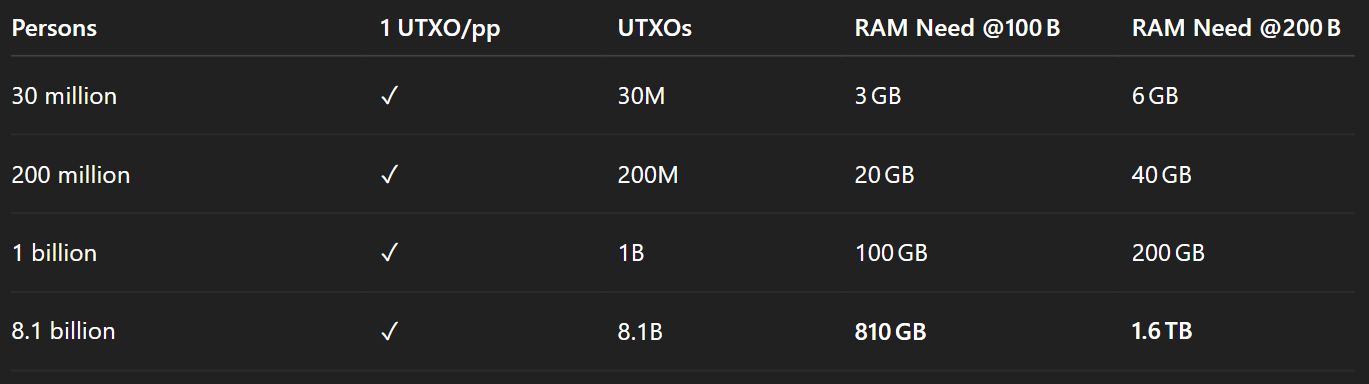

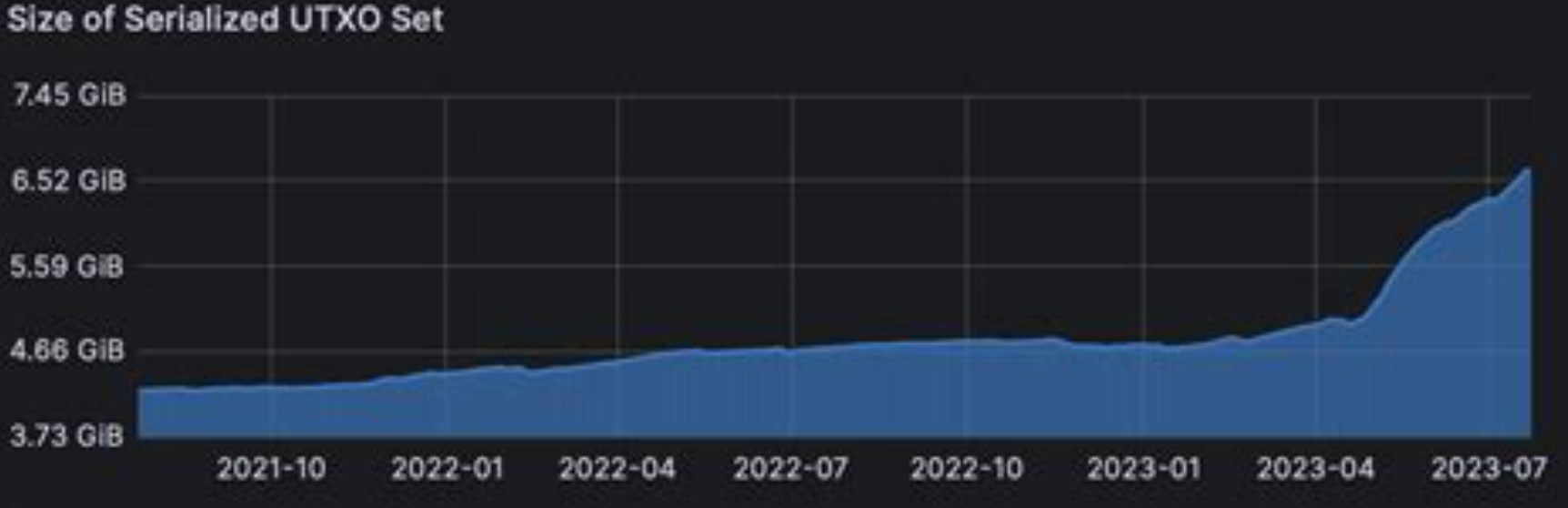

Currently, there are around 200 million funded Bitcoin wallets. That might sound like a lot, but it's just a fraction of global adoption. The real number of unique users is likely much smaller, as individuals and organizations hold many wallets. And even with just this modest level of usage, the UTXO set already consumes 4 to 5 gigabytes of RAM on every full node. That state must be held in memory to validate transactions in real time and prevent double spending. It cannot be pruned.

Now imagine scaling this up.

Let’s say every person on Earth had just one wallet. That’s 8.1 billion people. If each had a single UTXO, and we assume an average of 100 bytes per UTXO (a very conservative estimate), that’s over 810 gigabytes of UTXO data. If every person had even just 10 UTXOs - a realistic assumption given change outputs, dust, and multiple addresses - we're now talking over 8 terabytes. In RAM. Permanently.

Bitcoin’s architecture was not built for that scale, and there is no clean way to fix this within the constraints of the UTXO model.

Gresham's Law

Bitcoin is sound money. In fact, it's too sound to be used casually.

This brings us to Gresham’s Law: Bad money drives out good. When people have both hard money (like gold or bitcoin) and soft money (like fiat), they tend to spend the soft money and hoard the hard money. That’s exactly what’s happening with Bitcoin today. It is treated as digital gold - not everyday money.

And that's okay. Bitcoin serves a critical role as a global settlement layer and a hedge against monetary abuse. But the world also needs bad money. Not worthless money. Not hyperinflated money. But money that is designed for spending, liquidity, and velocity — without undermining the security of the monetary base.

The mistake is when people try to force Bitcoin to play both roles. Layer 2s like Lightning Network help reduce on-chain pressure, but they rely on the same UTXO constraints and recreate centralization through liquidity hubs and custodians. When people propose new systems "backed by Bitcoin", all they really do is recreate trusted third parties — the exact thing Bitcoin was meant to eliminate.

We need a fundamentally different model for a currency that is spendable, scalable, and still sovereign.

Enter Contractless - a better bad currency

Contractless uses a radically different accounting system that I call balance sheets. It’s inspired not by crypto gimmicks or smart contracts, but by the way banking worked before fractional reserves, checks, and credit cards. In those days, a person’s bank account reflected exactly what they had. You could only spend what was on your ledger. No credit. No trust. Just balances.

In Contractless, there are no UTXOs. There are no Merkle trees. Each account’s balance is tracked directly in a verifiable, append-only system that makes double-spending impossible without consensus fraud. The entire model revolves around pre-validating every transaction, ensuring it doesn't even enter the ledger unless it's already valid. That eliminates the need for a mempool, removes the risk of race conditions, and allows for unprecedented scalability.

The goal isn’t to build a new form of Bitcoin. The goal is to build a better bad currency — one designed for velocity, usability, and mass adoption, while still preserving sovereignty and decentralization.

Contractless is not here to replace Bitcoin. It’s here to complement it. To give the world a spendable digital currency that doesn’t require trust, doesn’t rely on centralized custodians, and doesn’t break under its own architecture.

A truly usable currency for the real world needs to start with a fundamentally different model — not just a different narrative.